This blog post was made and written by our panel of IRD tax agents. Like this post? Please share with your fellow Kiwi so we can help them out!

Guide To Choosing A Business Structure

WHAT IS THE BEST BUSINESS STRUCTURE (FOR YOU)?

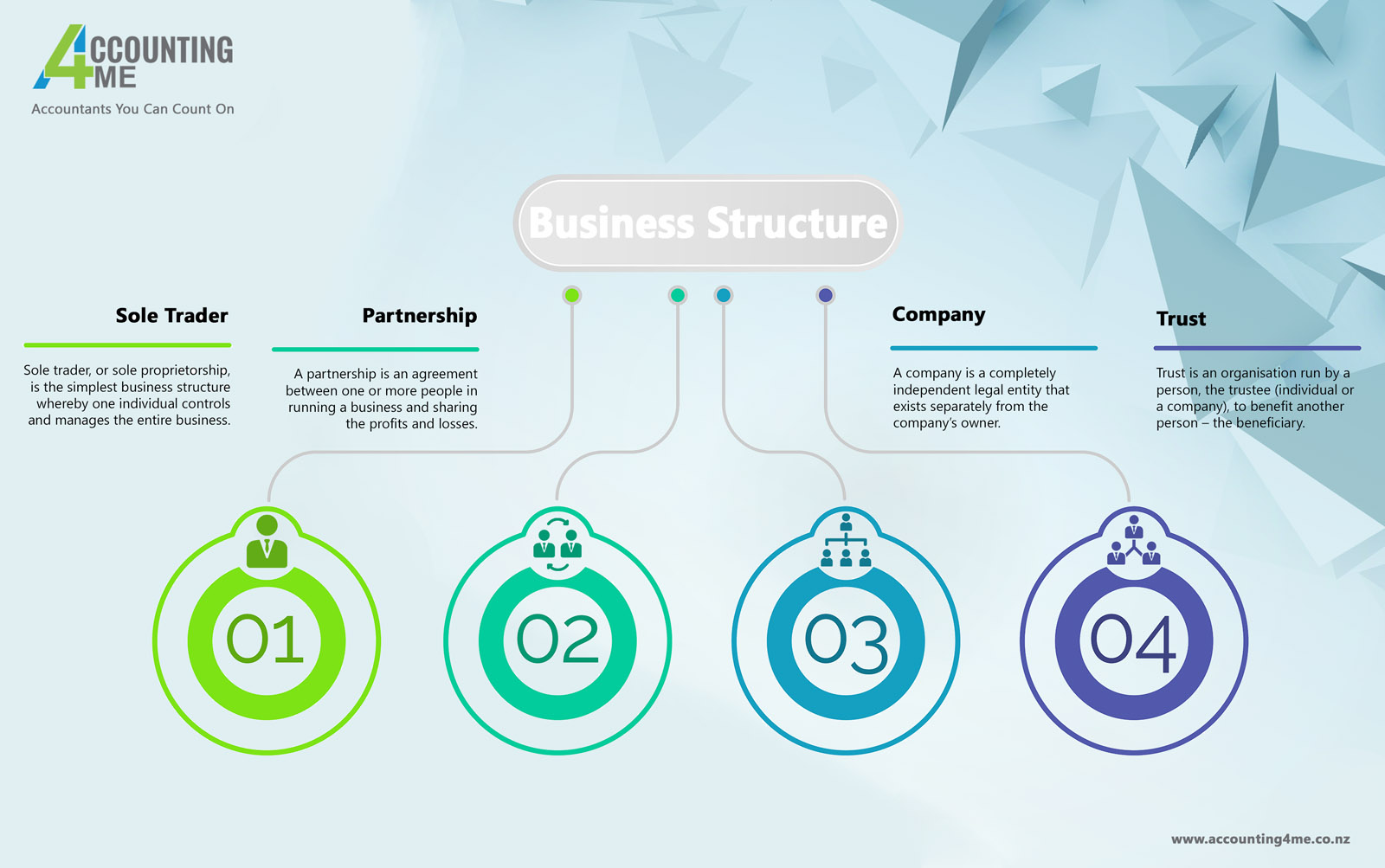

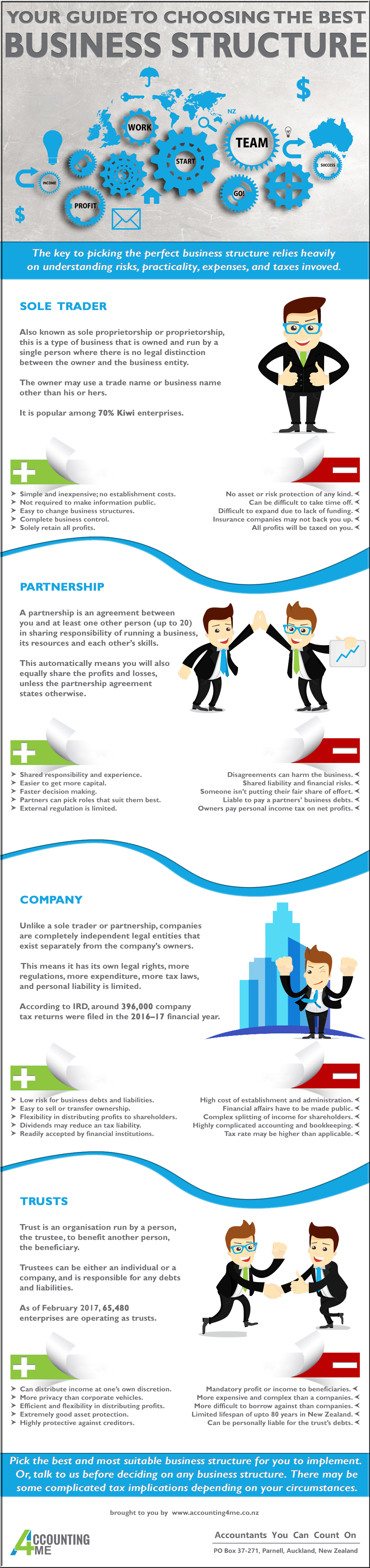

Deciding on the perfect business structure for you does not have to be complicated, although it is pivotal. Here, we have outlined the various negatives and positives of each business structure which can help you decide which of four most-popular business structure best suits your needs.

As per Stats NZ, until Feb 2017, New Zealand has over 528,170 enterprises running with 65,930 startups; Out of which, 57,500 startups failed and had to cease operations.

Therefore, understanding the benefits and considerations of each business structure can help you figure out which structure is right for you, depending on your potential business and how you want to run it.

Factors To Consider When Choosing A Business Structure:

⟹ Risk assessment.

⟹ Practicality and feasibility.

⟹ Cost and expenses.

⟹ Taxes and laws.

⟹ Ease of closing or transferring

NZ Business Statistics (as per Stats NZ):

⟁ 71% of all enterprises have no employees.

⟁ 27% have 1–19 employees.

⟁ Less than 1% had 100 or more employees.

⟁ Enterprises with 100 or more employees engaged 47% of all employees.

SOLE TRADER

It may sound easy to start a business, work for yourself or work as a contractor for someone else, but is it meant for you? A sole trader controls and manages their own business. But this doesn't mean you have to work alone, you can still employ workers, just that, you are totally responsible and accountable for the company.

FACT: Sole trader business structure is popular among 70% of all Kiwi enterprises.

Positives |

Negatives |

| ⟹ Simple and inexpensive with no establishment costs. | ⟹ No asset or risk protection of any kind. |

| ⟹ Complete business control. | ⟹ Can be difficult to take time off. |

| ⟹ Solely retain all profits. | ⟹ Difficult to expand due to lack of funding. |

| ⟹ Not required to make information public. | ⟹ Insurance companies may not back you up. |

| ⟹ Easy to change business structures. | ⟹ All profits will be taxed on you. |

PARTNERSHIP

A partnership is an agreement between you and at least one other person (up to 20) in sharing the responsibility of running a business, its resources and each other’s skills. This automatically means you will also equally share the profits and losses unless their partnership agreement states otherwise.

Positives |

Negatives |

| ⟹ Responsibility and experience are shared. | ⟹ Disagreements can harm the business and relationship. |

| ⟹ Can be easier to get more capital. | ⟹ Shared liability and financial risks of the business. |

| ⟹ Easier and faster to make decisions. | ⟹ One or more partners aren’t putting a fair share of effort. |

| ⟹ Partners can perform roles that suit them best. | ⟹ Liable to pay a partners’ business debts. |

| ⟹ External regulation is limited. | ⟹ Owners pay personal income taxes on the net profits. |

COMPANY

Unlike a sole trader or partnership, companies are completely independent legal entities that exist separately from the company’s owners. This means it has its own legal rights, many more regulations, even more tax laws, and personal liability is limited.

FACT: According to IRD, 396,000 company tax returns were filed in the 2016–17 financial year in NZ alone.

Positives |

Negatives |

| ⟹ Less risk for business debts and liabilities. | ⟹ Extra costs of establishment and administration. |

| ⟹ Easy to sell or transfer ownership. | ⟹ Financial affairs are made public. |

| ⟹ Flexibility in distributing profits to shareholders. | ⟹ Complex splitting of income by way of shareholding. |

| ⟹ Dividends may reduce an individual’s tax liability. | ⟹ Requires highly complicated accounting. |

| ⟹ Readily accepted by financial institutions and customers. | ⟹ Tax rate may be higher than that applicable. |

TRUST

Trust is an organisation run by a person, the trustee, to benefit another person – the beneficiary. The trustee can be either an individual or a company and is responsible for any debts and liabilities. Though they are generally referred to as companies, which is convenient, it is incorrect and misleading.

FACT: As of February 2017, 65,480 Kiwi enterprises are operating as trusts.

Positives |

Negatives |

| ⟹ Trustees can distribute income at their discretion. | ⟹ Distributing profit or income to beneficiaries each financial year. |

| ⟹ Provides more privacy than a corporate vehicle. | ⟹ More expensive and complex than a company structure. |

| ⟹ Tax efficient, confidential, and flexibility in distributing profits. | ⟹ More difficult to borrow against than a corporate structure. |

| ⟹ Very effective in asset protection and against creditors. | ⟹ Limited lifespan (up to 80 years in New Zealand). |

| ⟹ Beneficiaries pay tax on income they receive at their own marginal rate. | ⟹ Trustees can be personally liable for the trust’s debts. |

Our accountants can assist you with picking the best and most suitable business structure for you to implement - so come and try us out for free! You can decide later if you need extra paid service from our accountants.

Infographic on 'What Is The Best Business Structure For You?'

“We got great suggestions on how to get the most from our tax savings. I'm glad we made the decision to go with Accounting4Me.”

Hannah

Contact Details