This blog post was made and written by our panel of IRD tax agents. Like this post? Please share with your fellow Kiwi so we can help them out!

Best Bookkeeping Checklist NZ | Bookkeeping NZ

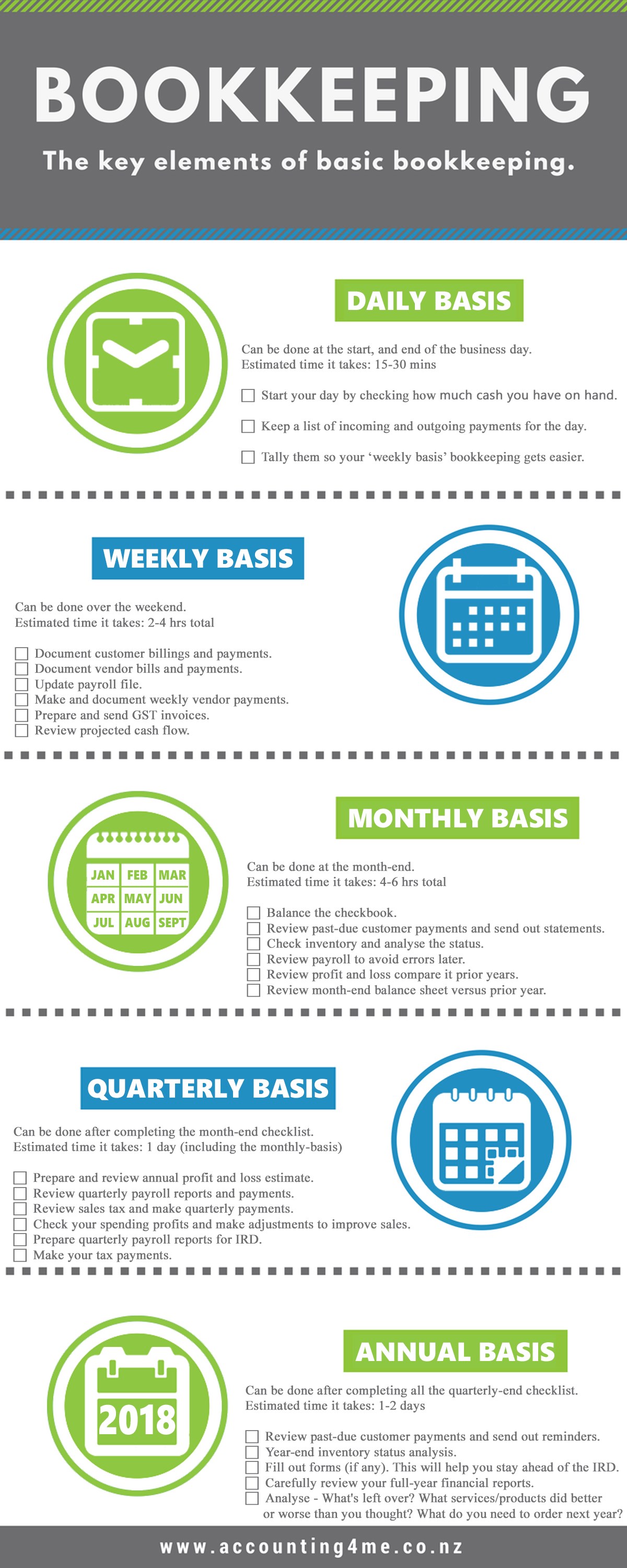

BOOKKEEPING - YOUR STARTER PACK CHECKLIST

As the year starts off, you'll probably find that managing your business finances is not easy, in fact, it can be downright overwhelming and taxing on your livelihood. But wait, there's a way to make this easier for you. Follow this basic bookkeeping checklist to the dot, and, within a few weeks, you will surprise yourself with the results. Just remember to keep all receipts, statements, and documents for cross-checking and proofs later.

Now that you’ve seen the infographic, here is a more detailed explanation of each bullet point.

DAILY BASIS:

Can be done at the start, and end of the day.

Estimated time it takes: 15-30 mins total

❏ Start your day by checking how much cash you have on hand.

❏ Keep a list of incoming and outgoing payments for the day.

WEEKLY BASIS:

Can be done over the weekend.

Estimated time it takes: 2-4 hrs total

❏ Document customer billings & payments calculated from the daily basis list.

❏ Document vendor bills & payments calculated daily and/or weekly.

❏ Update payroll file.

❏ Make and document weekly vendor payments (if any).

❏ Prepare & send GST invoices.

❏ Review projected cash flow (critical for start-up businesses).

MONTHLY BASIS:

Can be done at the month-end.

Estimated time it takes: 4-6 hrs total

❏ Balance the checkbook.

❏ Review past-due customer payments and send out overdue reminder statements.

❏ Check inventory and analyze the status. Reorder products that sell quickly and identify others that are moving slowly.

❏ Process & review payroll to avoid having to make corrections during the next payroll period.

❏ Review profit & loss compared to budget and prior years. This highlights where you may be spending too much or not enough.

❏ Review month-end balance sheet versus prior year so you get a picture of how you are managing assets and liabilities.

QUARTERLY BASIS:

Can be done after completing the month-end checklist.

Estimated time it takes: 1 day (including the monthly-basis)

❏ Review quarterly payroll reports & payments as, in most cases, IRD may require your quarterly payroll reports.

❏ Review Sales Tax and Make Quarterly Payments so you can stay up to date and well informed.

❏ Make your tax payments.

❏ Prepare and review annual profit & loss estimate so you can see how you are spending profits and making adjustments to improve sales and margins.

ANNUAL BASIS:

Can be done after completing all the quarterly-end checklist.

Estimated time it takes: 1-2 days

❏ Review past-due customer payments and send out overdue reminder statements. Just like monthly, but in its final and complete form.

❏ Fill out forms (if any). This will help you stay ahead of the IRD deadline.

❏ Carefully review your full-year financial reports before submitting them or you sign anything.

❏ Year-end inventory status analysis. How did the year go for you? What's left over? What services/products did better or worse than you thought? What do you need to order for next year?

Remember, your documents, statements, and receipts are important to keep for 7 years as per NZ business laws. And it might take a little while to get used to following a set procedure, but what isn't at first? If you want to not have to deal with a few of the things listed here, join us and we’ll talk.

“We got great suggestions on how to get the most from our tax savings. I'm glad we made the decision to go with Accounting4Me.”

Hannah

Contact Details